ESG refers to management and investment criteria based on "environmental, social and corporate governance

2025/01/31

ESGmeans that the environment (Environmental), social (Ssocial), corporate governance (G(overnance),Criteria for management and investment activities aimed at a sustainable societyIn recent years, the terms "ESG investment" and "ESG management" have attracted attention, and in particular, the amount of ESG investment is increasing every year, making it an important theme for companies.

This is due to the growing interest in climate change and social issues, as well as the increased attention that investors and consumers are paying to corporate sustainability.

ESG is more than just a risk management tool,It is a key element that enables a company to grow and become more competitive in the long term。

This article provides a detailed explanation of ESG, including basic ESG elements, specific examples, actual company case studies, and steps to further address ESG.

Table of Contents

- 1 ESG investment" is a growing trend worldwide

- 2 Three elements of "ESG" and specific examples

- 3 Five Benefits of ESG Management

- 4 Five Corporate Case Studies of ESG Initiatives

- 5 Three Issues in ESG

- 6 Six Steps to Addressing ESG

- 6.1 Step 1: Analysis of current situation and identification of issues

- 6.2 Step 2: Identification of ESG Priorities

- 6.3 Step 3) Goal setting and strategy formulation

- 6.4 Step 4: Develop internal systems and implement initiatives

- 6.5 Step 5: Measure and improve progress

- 6.6 Step 6: Information Disclosure and Communication

- 7 Conclusion

ESG investment" is a growing trend worldwide

In recent years,ESG Investing."is attracting attention around the world and is positioned as an important keyword in the pursuit of a sustainable society.

What is ESG investment?Investments made with ESG (Environmental, Social and Corporate Governance) factors in mindESG investing continues to grow as companies seek to address environmental issues and emphasize social responsibility.

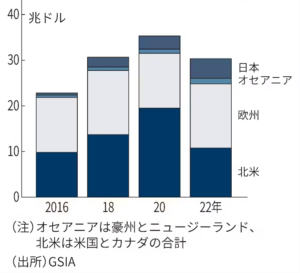

Please see the following graph from an article in the Nihon Keizai Shimbun.

◆Global ESG Investments by Region

As a result of the spread of the ESG concept, particularly in Europe, and increased awareness of sustainable investment in all regions, the overall amount of ESG investments has been steadily rising and has achieved steady growth.

However,Global ESG investments will decline for the first time in 2022, down 14% from the previous year30.3 trillion dollarsnow that it has become ...According to the article, this decrease is mainly due to a halving of investments in North America, which is believed to be due to greenwash criticism and stricter standards.

The Ukraine crisis and inflation also contributed to the strong performance of fossil fuel-related stocks, while ESG funds, which had shifted their focus to environment-related stocks, did not perform well.

In any case, this decrease is expected to be temporary,Europe, Oceania, and Japan continue to expand.

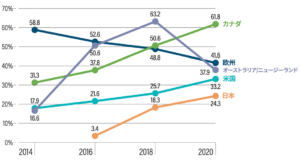

Next, we will also look at ESG investments as a percentage of the total.

◆Total ESG investments as a percentage of total assets under management

Source:GLOBAL SUSTAINABLE INVESTMENT REVIEW 2020(GSIA)A part of the author processing

In Europe, the share of ESG investments has declined from 58.8% in 2014 to 41.6% in 2020; this decline is believed to be due in part to the impact of stricter definitions of sustainable investment in Europe, and does not represent a decrease in the amount of investment itself.

On the other hand,In Japan, the growth has been rapid since 2016, reaching 24.3% by 2020.This reflects the growing interest in sustainability among businesses and investors.

Overall, ESG investments are expanding in many regions, although the pace and direction of growth varies.Environmental and social considerations" have become a major theme in financial markets, leading to investment behavior and corporate strategy.This is considered to be the case.

The next section details the three components of ESG.

Three elements of "ESG" and specific examples

ESG.Environmental, Social, and Corporate Governance.We have already mentioned that the concept refers to the following three elements, but here we will explain in detail what these three elements specifically entail.

Element ① Environment (Environmental)

The elements in the "environment" are,Climate change, resource management and ecosystem protectionThis refers to how companies address global issues such as

◆Specific examples of environmental elements

Reduction of greenhouse gas emissions

Reduce waste and promote recycling

Biodiversity Conservation

Many manufacturing industries are adopting solar and wind power generation to reduce energy consumption in their production plants, and retailers are becoming increasingly common in their efforts to reduce waste by using recyclable materials for product packaging.

Elements ②Social (S(ocial)

Elements in the "society" are the companies'How do we fulfill our responsibilities to our stakeholders, including the work environment, local communities, and customers?Refers to.

◆Specific examples of social elements

Promoting Diversity

Initiatives to protect human rights throughout the supply chain

Contribution to Local Communities

Some international companies have put in place mechanisms to eliminate child labor throughout their supply chains, while others in the IT and financial industries have introduced leadership development programs to enable women, minorities, and other diverse groups to play an active role, and other diversity-oriented initiatives are underway.

Element ③ Corporate Governance (Governance)

Corporate governance is,Management transparency and accountability, legal compliance, and shareholder relationsand other mechanisms to ensure the sound operation of the company.

◆Specific examples of corporate governance

Strengthening the compliance system

Improve transparency of information disclosure

Constructive dialogue with shareholders

For example, many companies are taking steps to strengthen oversight by inviting outside experts to join their boards of directors, and an increasing number are including detailed non-financial information in their annual reports to ensure transparency in disclosure.

Thus, each of the three ESG elements-environment, society, and corporate governance-plays an important role in corporate activities,This is the foundation for a sustainable society in the future.

What are the actual benefits of corporate ESG initiatives?

Five Benefits of ESG Management

In today's society, a company's commitment to ESG, orESG ManagementDoing so brings a variety of benefits; here are the five main ones.

Advantage 1: Increased corporate value

ESG initiatives will enhance the reputation of the company as a company that strives for sustainable growth and improve its brand value and corporate image.It is easier to gain the trust of investors and consumers, andThe Company will strengthen its long-term earnings base.

According to the following article,Companies with high ratings for non-financial factors, including ESG,Leads to lower cost of capital and higher expected profit growth rate.It has been confirmed that

Advantage 2) Support from investors

ESG investment is expanding globally, and companies that practice sustainable management are more likely to be selected for investment.Easier access to funding and attention from institutional investorsThis is also a major advantage.

The following is based on a survey of investors based in Japan conducted by the QUICK ESG Research Institute.

◆Assets under management of Japanese equities and ESG investments

Source:ESG Investment Status Survey 2023① ESG ratio "90% or more" 33%, 46% after 5 years (QUICK ESG Research Institute)A part of the author processing

The results of this survey show,ESG investment balance was approximately 104.3 trillion yen, an increase of approximately 22.6 trillion yen from the previous year.This indicates that investors are becoming increasingly interested in the market.

Advantage 3: Attraction and retention of excellent human resources

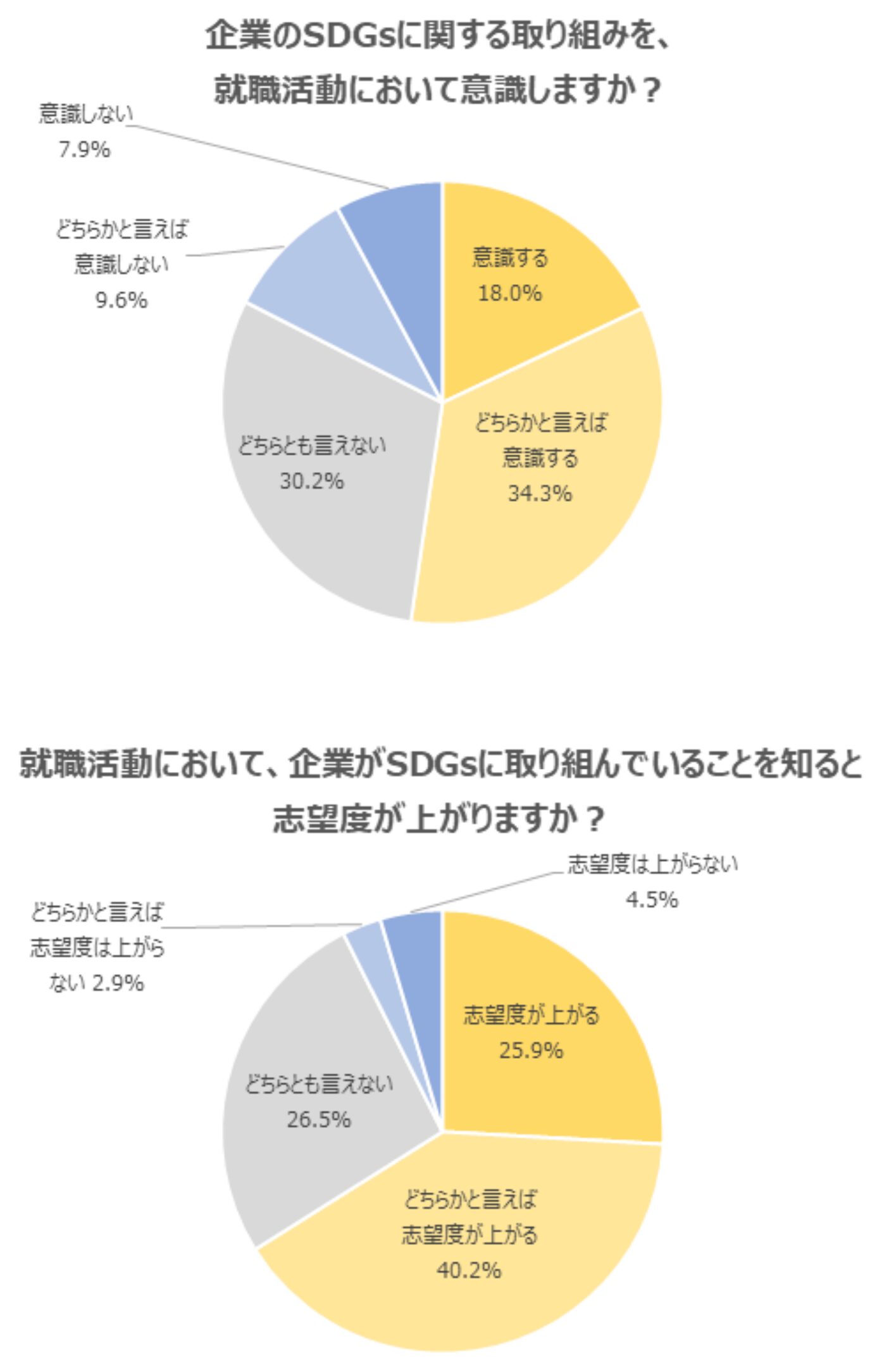

DiversityA commitment to excellence and the creation of a pleasant work environment will help attract and retain the best talent, especially in the areas ofYounger job seekers tend to be more attracted to companies that are committed to ESG。

The following are the results of a survey on job hunting conducted by Gakujyo Corporation for undergraduate and graduate students who are about to graduate (complete their studies).

◆Attitude survey results for job seekers

Although the above questionnaire is about the SDGs, it can be taken as the results of a questionnaire about ESG as it is, since corporate efforts to address ESG will also contribute to the achievement of the SDGs.

From these results,Companies that are actively involved in ESG and SDGs attract interest from job seekers and attract the best talent.You will understand that.

Advantage 4: Regulatory compliance and increased competitiveness

As ESG-related regulations are tightened in many countries, proactively responding to these regulations will differentiate us from our competitors.

For example,Achieve carbon neutrality goals and protect human rights throughout the supply chainto move forward, we can gain the support of many of our stakeholders and increase our competitiveness in the global marketplace.

Advantage 5: Consumer support

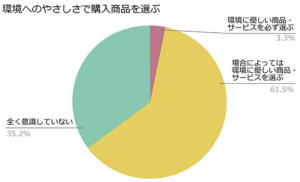

Below is a graph showing the results of a consumer survey, taken from the Internet Shop Managers Forum.

◆When purchasing goods and services, do you choose whether they are environmentally friendly or not?

The graph shows that 3.3% of respondents "always choose eco-friendly products and services" and 61.5% "choose eco-friendly products and services in some cases,Consumers.Increasingly, people are choosing companies that offer environmentally and socially conscious products and servicesYou will understand that.

By implementing ESG management,Increase customer loyalty and attract new customersThis leads to.

Thus, ESG management goes beyond simply improving a company's image,Fulfilling our social responsibility also improves our corporate value over the medium to long term.And at the same time,Key Strategies to Enhance CompetitivenessIt can also be said that

In the next section, we will present examples of companies that are actually implementing ESG-conscious initiatives.

Five Corporate Case Studies of ESG Initiatives

In this section, we highlight the initiatives of five actual companies and present specific examples of their practices, divided into "Environmental," "Social," and "Corporate Governance" categories.

Case Study 1: Toyota Motor Corporation

Environment

Toyota has set a long-term goal of "Toyota Environmental Challenge 2050,Virtually zero CO2 emissions from vehicles and production processes by 2050The goal is to make the

Under this initiative, challenges such as "reducing CO2 emissions throughout the vehicle life cycle," "becoming carbon neutral at plants," and "effectively using water resources and preserving the local environment" are being promoted.

Society

Under the philosophy of "Mobility for All," we are developing mobile barrier-free toilets with the aim of realizing a society in which everyone, including people with disabilities and the elderly, can move around with peace of mind.

Governance

Toyota has established a governance structure that emphasizes transparency and fairness.Approximately half of the Board of Directors is composed of independent outside directors, and through the establishment of the Nomination and Compensation Advisory Committee and the strengthening of the risk management system, the Company is working to ensure that the Company's Board of Directors is comprised of independent outside directors.The company is committed to ensuring the soundness of its management.

Reference: ESG (Environmental, Social and Governance) based initiatives (Toyota Motor Corporation)

Case Study 2: SoftBank Corp.

Environment

Softbank is a climate change solution,Virtually zero greenhouse gas emissions by 2030The goal is to achieve the following

In addition, we have been taking effective measures such as operating data centers using renewable energy and installing energy-saving equipment in offices, etc. Furthermore, based on the TCFD recommendations, we have been enhancing information disclosure on environment-related risks and opportunities.

Society

To eliminate regional disparitiesThe Bridging the Digital Divide Project.For example, through the spread of 5G and Wi-Fi, we are creating an environment where high-speed communications are available even in rural and underpopulated areas.

Also, as part of educational support,Supporting the GIGA School Initiative to provide ICT education to children。

Governance

We have established an ESG Promotion Committee, which reports directly to the Board of Directors, and this committee manages the progress of ESG activities and formulates strategies, which are reflected in our corporate activities.

We are also strengthening disclosure to shareholders and stakeholders to ensure transparency of non-financial information.

Reference: Major ESG Initiatives (SOFTBANK CORP.)

Case Study ③ Mitsubishi Corporation

Environment

MC is a climate change action,TCFD (Task Force on Climate-related Financial Disclosures)We are taking advantage of the recommendations of the "Mere Old Man" to capture growth opportunities and respond to risks.

For example, the company developed a policy for coal-fired power project initiatives,Shift to low and decarbonization projectsWe are also conducting 1.5°C scenario analyses and physical risk assessments to examine in detail the impact of climate change on our operations.

Society

The company is committed to fulfilling its social responsibility by setting targets for the year 2030 for its key sustainability issues.

Specifically, we aim to realize a vibrant organization where diverse human resources create the future,Promoting diversity management and wellbeing (occupational health and safety, health management)。

Governance

In terms of governance, we are committed to contributing to the material and spiritual enrichment of society and the preservation of the global environment through our business, in accordance with our corporate philosophy, the Three Corporate Principles.

Based on this philosophy, we have established a sustainability promotion system and are promoting strategic initiatives on ESG issues under the supervision of the Board of Directors. to strengthen our risk management system, we have also established a Compliance Committee to ensure compliance with laws and regulations and corporate ethics.

Case 4: Sekisui House, Ltd.

Environment

Sekisui House has declared itself "carbon neutral" to achieve virtually zero CO₂ emissions by 2050, and is promoting the creation of energy-efficient homes by promoting the high thermal insulation of homes and the introduction of solar power generation systems.

In addition,Green First Zero" project for environmentally friendly urban developmentThe goal is to create a community that is symbiotic with nature.

Society

To promote the success of a diverse workforce,Increasing the ratio of female managers and hiring foreign employeesIn addition, to create a comfortable work environment for employees, we support flexible work styles by promoting telework and introducing a flextime system.

Furthermore, the company places emphasis on coexistence with local communities, providing assistance to disaster-stricken areas and conducting environmental education programs for children.

Governance

The company has increased the ratio of outside directors to strengthen the functions of the board of directors, ensuring management transparency and independence, and has established a Compliance Committee to strengthen the risk management system and ensure compliance with laws and regulations and corporate ethics.

In addition, we promote strategic initiatives on ESG issues through our Sustainability Committee.

Reference: Sekisui House's Environmental Initiatives (Sekisui House, Ltd.)

Case 5: Kao Corporation

Environment

Kao is,Reduce our own CO₂ emissions by 55% from 2017 levels by 2030The goal is set to

We promote the use of refillable products and recycled plastics to reduce the environmental impact of our products throughout their life cycles,Preservation of water resourcesWe are also focusing on reducing water consumption in the production process and developing water-saving products.

Society

With a commitment to promoting diversity and inclusion, we are working to increase the ratio of women in management positions and to promote the employment of people with disabilities. we also emphasize employee health management and have introduced a program to promote health management.

As for contributions to the local community,Actively involved in educational support and disaster relief activities。

Governance

To strengthen corporate governance, Kao has enhanced management oversight by having more than half of its Board of Directors consist of outside directors, and has also established the Nomination and Compensation Committee to ensure transparency in management appointments and compensation decisions.

We are also focusing on the development of internal control systems and enhancing our risk management and compliance systems.

Reference: Kao's ESG Strategy (Kao Corporation)

Next, we will discuss some of the challenges facing ESG.

Three Issues in ESG

As mentioned above, ESG investment and ESG management are gaining attention around the world as a means to achieve a sustainable society; however, despite their growing popularity, ESG also presents several challenges.

This section describes three typical ESG issues.

Issue 1) Lack of clear criteria and evaluation indicators

ESG is attracting a lot of attention around the world,Its evaluation and reporting standards are not uniform.The challenge is the lack of comparison and transparency; the ambiguity of criteria makes it difficult for investors and stakeholders to make decisions when measuring how a company is implementing ESG practices.

As an indicator to assess a company's ESG effortsESG Score."Although there are some that say,The standards differ from one evaluation organization to another, or from country to country or industry to industry, so it cannot be said that they fully fulfill their role as "uniform standards.。

Issue #2: Insufficient reliability and transparency of data disclosed by companies

The reliability of ESG-related data provided by companies is a challenge.

In fact, according to the findings of Deloitte Tohmatsu, in collecting ESG data,More and more companies each year are experiencing challenges such as spreadsheet complexity, poor data accuracy, and input errorsIt is said.

Citation: Survey 2024 on ESG Data Collection and Disclosure (Deloitte Tohmatsu)

In particular, incomplete or ambiguous data on emissions and working conditions risk misleading investors and stakeholders in their assessments.

Issue 3) Difficult to lead to short-term profits

While ESG initiatives can contribute to medium- and long-term benefits, they are less likely to lead to short-term gains.Some managers and investors may have difficulty understanding ESG investments because of their focus on short-term profitsThese levels demonstrate how accessible a website is.

These are challenges that many companies face when promoting ESG, and seeking solutions to each of them is essential to ESG success.

Next, we will explain some concrete steps that can be used as a reference for ESG initiatives, as a systematic approach is important for effective ESG promotion.

Six Steps to Addressing ESG

Here is a framework to help companies address ESG,The following six stepsThe system was disassembled into

Step 2: Identification of ESG Priorities

Step 3) Goal setting and strategy formulation

Step 4: Develop internal systems and implement initiatives

Step 5: Measure and improve pa progress

Step 6: Information Disclosure and Communication

Specific procedures for each will be explained.

Step 1: Analysis of current situation and identification of issues

In order to understand the ESG issues facing a company, we conduct a thorough analysis of the company's current situation and identify the challenges and risks in ESG.

Utilize benchmarks within and outside the industry,Understand where your company standsand identify areas for improvement based on investor and consumer expectations.

Step 2: Identification of ESG Priorities

Based on the analysis of the current situation, we will develop a plan that will be useful to our business and stakeholders.Most important ESG issues (materiality)Identify the

For this,“A Materiality Analysis."It is called the company'sTo identify issuesframework to assess the importance and impact of issues.By clarifying priorities, limited resources can be allocated efficiently and effective measures can be developed.

Step 3) Goal setting and strategy formulation

Specific numerical targets and timelines are set, and strategies and concrete action plans are developed to achieve these goals.Goals should be specific and measurable (numerical targets are ideal), and a roadmap for their achievement should be developed and the necessary resources and personnel secured。

Furthermore,Goals are realistic and at the same time enhance the competitiveness of the companyConsideration should be given to ensure that this is the case.

Step 4: Develop internal systems and implement initiatives

To put the plan into action,Establish a sustainability committee or appoint a responsible personand other internal systems, and develop specific ESG measures on a company-wide basis.

In addition, through education and training for employees, we will deepen their understanding of ESG and implement integrated efforts throughout the organization.

Step 5: Measure and improve progress

We will continuously strengthen our efforts by measuring the progress of ESG measures quantitatively and qualitatively, and taking remedial measures as necessary.

Specifically,TCFD (Task Force on Climate-related Financial Disclosures)※1and GRI (Global Reporting Initiative).※2This data serves as an important basis for stakeholder reporting and decision-making.

By implementing this step, we will fulfill our accountability to our stakeholders and at the same time maximize the effectiveness of our ESG activities by making further improvements based on the results obtained.

1 TCFD: An international framework for disclosing the financial impact of climate change on companies.

2 GRI: A non-profit organization that sets international standards for sustainability-related information disclosure.

Step 6: Information Disclosure and Communication

We will transparently disclose the results of our ESG activities and build relationships of trust through communication with our stakeholders, including investors and consumers.

Specifically,Sustainability reports and integrated reportsand make information available online and through events.

Through these six steps, companies can further strengthen their sustainability efforts and enhance their social reputation.

This section was released by the Japan Exchange Group and Tokyo Stock Exchange.ESG Disclosure Practices HandbookFor more detailed information on how to work with them, please visitPlease see the full handbook from the official page below。

Reference: ESG Disclosure Practice Handbook (Japan Exchange Group)

Conclusion

ESG (Environmental, Social, and Governance) initiatives will enable the company to achieve sustainable growth andImportant perspectives in corporate management and investmentThe company is attracting attention around the world as a

For companies, environmental protection, social responsibility, and transparent governance are not just about meeting regulatory and stakeholder expectations,It also leads to long-term growth and competitiveness of the company。

ESG not only contributes to corporate risk management and brand value enhancement, but is also an important activity for the realization of a sustainable society, and it is hoped that the spread of ESG will contribute to the realization of a more sustainable and prosperous society.

-

Contact Us

-

Request Info

-

Free Trial

-

Partner System